HOW TO UNLUCK ET TOKEN ON SUPEREX EXCHANGE

How do I unluck ET TOKEN ON SUPEREX EXCHANGE? With this step-by-step guide, creating an account and ordering is easy and hassle free.

Ever since unboxing the ET token, users haven’t had a way to actually use it. There was no address given for the tokens and there was no button asking users if they wanted to transfer their ET tokens on SUPEREX Exchange under the button “Confirm”. I talked in this article about how to unlock your ET tokens by exploring it and how the airdrop might be executed

Read also

Number 1 is by trading future

What is Futures trading? How to trade Futures(For complete beginners), Unlocking ET Airdrop, and the advantages of trading futures on superEx.

The first step toward futures trading is to understand what futures contracts are. A futures contract is an arrangement between two parties to buy or sell a commodity, such as digital currency, at a preset price on a specific date. The contract keeps track of an underlying asset, which could be a stock, a commodity, or a digital currency. In essence, it is a bet on the direction of price changes in the future.

With the aid of a futures contract, a buyer and seller can reach an agreement to exchange an asset for a defined sum later. Although a futures contract offers the possibility for the delivery of an item, the majority do not result in physical delivery and are instead utilized by investors to speculatively predict a security’s price or manage risk in a portfolio.

There are several ways to gain exposure to cryptocurrencies, but one of the most well-liked and practical methods is futures trading.

Futures trading is a way to speculate on an asset’s price, including the price of cryptocurrencies, without really owning it. The future price of a digital currency can be predicted by traders using cryptocurrency futures, just like with commodities or stock futures. Without a doubt, Bitcoin futures are the most widely traded form of cryptocurrency futures contracts at the moment.

You will get all the knowledge you need to better comprehend the intricacies of futures trading on superEx in this article. Whereas it can offer superior opportunities to spot trading.

Before trading on Futures, you must be well informed that Futures trading involves a lot of risks and one needs to be well informed about the risk and how to go about it.

Here are the quick simple steps on how to trade on futures.

When you successfully log on to your app, navigate to the futures trading section by following the simple steps

As you open the superEx mobile app this interface will be displayed… Click in the marked-out area of the screenshot…it’s at the bottom of the page

This will come up… You can either follow the instructions or skip

Thereafter you can click confirm to continue

On Trading Futures

Step 1

In the futures trading section at the menu, select Wallet, then select Cloud Wallet, then open the Futures interface. To use the Futures feature and transfer funds to a Futures account at the same time, click Transfer.

Step 2

Choose the futures account you want to move ( here, USDT is taken as an example). Enter the transferable amount. After ensuring that it is accurate, click “Confirm Transfer.”

Step 3

Select “open long” for bullish positions and “open short” for bearish positions when you enter the contract interface from the bottom navigation column. To open a position, choose “cross position,” “split position,” “isolated position,” and “market price” or “limit price,” then enter the margin then choose “leverage” and enter “amount.”, Then click ok to open position.

For beginners make sure your position is set to Isolated, in case of a loss, this will prevent the trade from getting into your account getting into your balance just like the Cross position

Step 4

Upon successfully placing an order, the position of the filled order will be shown in the “Positions” section with the view of your unrealized PNL, principal, amount, rate of income as well as liquidation price.

Please note that PNL stands for “profit and loss” so it can be either realized or unrealized. It can be used to describe the change in the value of a trader’s trade.

Liquidation price means The price at which the margin drops to zero,

and the principal means the margin USDT or amount trading in the open position.

while the Rate is the calculated percentage of profit or loss.

Advantages of Futures Trading

Leverage

Leverage is the use of different financial instruments or borrowed money, It is a type of investing technique which meant to increase the potential return on investment. With a lesser initial commitment, investors can purchase larger stakes by using margin trading in futures. However, this could have a double-edged effect if the asset’s price changes in an unanticipated way. Traders should be aware that they can lose more than their initial margin while trading futures contracts.

Diversification

Futures trading allows investors to trade everything from stock indices to orange juice, enabling them to diversify their portfolios across many asset classes.

Hedging

Futures contracts can be used by investors to limit prospective losses or safeguard unrealized gains. Due to the huge range of futures products available, traders can take a cost-effective hedge against the whole market as well as against particular industries and commodities.

broader market or specific sectors and individual commodities.

Disadvantages of Futures Trading

Everything with disadvantages surely comes with disadvantages, Trading futures will always come with a risk which it’s required of every trader to take note of and be careful of before engaging in a trade, Here are some of the most common causes of losses in trading futures.

Over-Leverage

There are two points of leverage. On one hand, it may be advantageous to increase profits while cutting costs. However, if the markets move against you, you’ll be responsible for any resulting losses and open to margin calls. Thus, using leverage will also result in higher losses.

Managing Expiration Dates

Traders must be aware of the expiration dates in the majority of futures contracts. As the contract nears its expiration date, the price may quickly decline or even lose all of its worth. Investors may roll their futures contract to a longer-dated one as the expiration date approaches to avoid this.

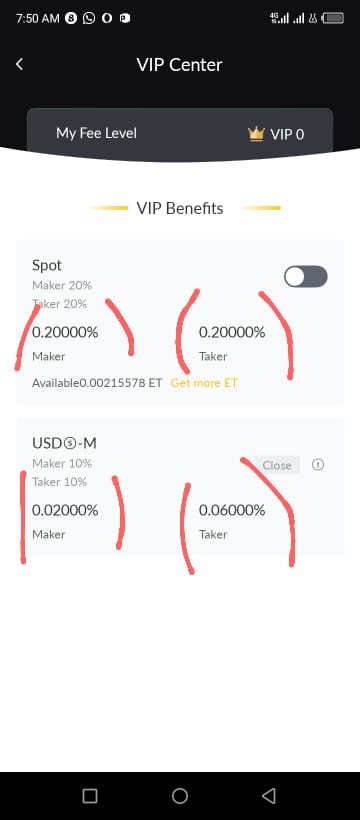

Fees in Futures Trading

Maker fees are simply fees charged by the exchange when one opens a position. Immediately you initiate a trade in the futures Market, the exchange charges a minimal fee for it.

Taker fees are simply fees charged by the exchange when a trader’s position is closed. These fees are higher than the maker fees.

The maker and taker model is a way to differentiate fees between trade orders that provide liquidity (maker orders) and take away liquidity (taker orders). Maker and taker trade orders are charged different fees

For example, if BTC/USD is currently trading at $31,000 and you submit a buy limit order for 1 BTC at a limit price of $30,000, this order will not be immediately executed.

Instead, it will be added to the order book. The order will “rest” on the order book and will not be executed unless the price falls to $30,000.

By placing this order, you’re referred to as a “maker” because you added liquidity or “made” a market.

Taker example: if BTC/USD is currently trading at $31,000 and you submit a market order for 1 BTC at $31,000, this order will be immediately executed.

By placing this order, you’re referred to as a “taker ” because you “took liquidity” from the market.

So a trader is either paying either the maker or taker fees, both will be charged by the platform

On unlocking your ET AirDrop

Before now unlocking the Airdropped ET requires both spot and futures trading, which means that as you trade, you get to unlock ET that is directly equal to your trading fee. In addition, as your invited friends trade both spot and futures, a portion of the ET unlocked from their end gets unlocked on yours as well. This has already been discussed extensively in space and the community.

However, each user must now engage in futures trading in order to unlock their token in order to ensure that everyone uses the platform and because we do not want to give out the token for free just to keep its utility.

So to unlock, one needs to trade and the cost of the trade to unlock is equal to the futures fee which is 0.08%

unlocking ET by trading futures.

Margin × leverage x trading fees /2 = open ET.

Note that your trading fee is a combination of both the makers and takers fee, Margin is a deposit made to protect an open futures position. Margin levels must be kept at the level specified by the brokerage company. After trade settlement and the closing of the futures position, any unspent margin funds may be repaid to the account holder.

Types of market orders in futures trading

A market order is a quick buy or sale of a cryptocurrency at the best price offered at that moment. You’re either buying or selling the assets at the current best price on the market.

A limit order is a contract(or agreement) that specifies a price at which you will purchase or sell a coin/token. For instance, ET is currently trading at 20USDT and I wish to open a buy position when the price is 21 USDT … I can automate the entry by setting a limit buy order at that price meaning that immediately price gets to that level, my position would automatically be opened.

A stop limit order is an agreement to buy or sell at a specific price once the stop price is reached. A stop limit order price consists of Stop Price and limits price.

A stop price is simply a price that activates the limit order. For instance, ET has a market price of 21USDT, and you see clearly that it’ll moon. You can set a stop price of 21.5 USDT and a limit order of 24 USDT meaning that if ET should get to 21.5 USDT, the limit order would automatically be set to buy at 24 USDT.

A stop-market order is a standing order to buy/sell a coin/token if the price reaches a certain level.

Just as the name implies, it’s an order to stop the market or close its position. The order is executed immediately after the market price hits the pre-set price.

It is used to cut losses or secure profit in a trade. So yes, it’s used to stop loss or take profit as the case may be. For instance, ET has a market price of 21USDT. It’s mooning and you’re already in a long position, you’re certain that if it hits 100 USDT that it’ll dip a bit, so you see a stop market order to close your position at 98 USDT, so you can secure your profit ( In this case it functions as a take profit order). The reverse is the case for stop loss.

On a final note, a number of business experts still believe the underlying crypto economy is yet insufficiently developed to support a futures market. These critics believe that the instability of Bitcoin might spread to other futures markets. However, due to the fact that most of them are not susceptible to cyberattacks, unlike standard crypto exchanges that store clients’ cryptocurrency holdings, no significant incidents have yet been reported by cryptocurrency futures platforms. For instance, trading futures on SuperEx has been very easy, secure, and convenient.

But despite using leverage that is always higher than the 2x and 3x that are recommended, which is always very attractive to newbies, there are risks related to market volatility, a 24-hour market, and ineffective futures trading strategies that are unchanged from traditional markets.

Before trading futures on superEx every user is assumed to have a very good knowledge of how future trading works and be ready to take responsibility for any loss.

In the long run, It is always advisable to trade what one can lose.

One Comment